north carolina sales tax rate on food

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. A customer buys a toothbrush a bag of candy and a loaf of bread.

How Do State And Local Sales Taxes Work Tax Policy Center

Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 75.

. Note that in some areas items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general purchases. The sales tax rate on food is 2. North Carolina Department of Revenue.

A bundled transaction that includes a prepaid meal plan is taxable in accordance with NC. Manufactured and Modular Homes. Apparel and Linen Rental Businesses and Other Similar Businesses.

Each of these districts adds its levy to the general sales tax. North Carolina has 1012 special sales tax. 20 feet with 50 amp connection.

Lease or Rental of Tangible Personal Property. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. North Carolinas sales tax rates for commonly exempted categories are listed below.

Kitchen Equipment Runs On. VEHICLE Year of Manufacture. The average combined tax rate is 695 ranking 24th in the US.

The average local rate is 22. Gross receipts derived from sales of food non-qualifying food and prepaid meal plans and the applicable sales and use tax thereon are to be reported to the Department on Form E-500 Sales and Use Tax Return or through the. Select the North Carolina city from the.

To learn more see a full list of taxable and tax-exempt items in North Carolina. Sales taxes are not charged on services or labor. As of 2014 there were 1012 taxing districts in North Carolina including counties cities and limited meal tax levies.

Two 6 feet hirozaki stainless steel with stainless work surface. Depending on local municipalities the total tax rate can be as high as 75. North Carolina counties may add a sales tax of up to 275 percent tax.

You can find sales taxes by zip code in North Carolina here. Best Food Trailers for Sale in Ohio. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Best Food Trailers for Sale in Illinois. The North Carolina NC state sales tax rate is currently 475 ranking 35th-highest in the US. This page describes the taxability of food and meals in North Carolina including catering and grocery food.

North Carolina has a 475 statewide sales tax rate but also has 459 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 222. But youd only charge the uniform reduced rate of 2 local tax on the loaf of bread. With local taxes the total sales tax rate is between 6750 and 7500.

Items subject to the general rate are also subject to the 225 local rate of tax that is levied by all counties in North Carolina. Food Non-Qualifying Food and Prepaid Meal Plans. Overview of Sales and Use Taxes.

Some examples of items that exempt from North Carolina sales tax are prescription medications some types of groceries some medical. Two 6 ft Hirozaki reach in cooler with stainless steel work. PO Box 25000 Raleigh NC 27640.

Prepared Food and Beverage Return and Instructionspdf One percent 1 of the sales derived from prepared food and beverages sold is assessed at retail for consumption on or off the premises are assessed by any retailer within the County that is subject to sales tax imposed by the State of North Carolina. Typical county total taxes are 675 to 7 percent. 15 cu ft avantco.

Food is exempt from the State portion of sales tax 475 but local sales taxes Articles 39 40 and 42 do apply to food to make up a 2 sales tax on food. Prescription Drugs are exempt from the North Carolina sales tax. 31 rows The state sales tax rate in North Carolina is 4750.

Local taxes apply to both intra-state and inter-state transactions. Ad Get North Carolina Tax Rate By Zip. General Sales and Use Tax.

According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7 475 NC state rate and 225 Cherokee County rate on the toothbrush and the candy. Best Food Trailers for Sale in North Carolina. North Carolina has recent rate changes Fri Jan 01 2021.

Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax.

Is Food Taxable In North Carolina Taxjar

Is Food Taxable In North Carolina Taxjar

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

As Food Prices Soar Some States Consider Cutting Taxes On Groceries

When Did Your State Adopt Its Sales Tax Tax Foundation

North Carolina Sales Tax Small Business Guide Truic

Is Food Taxable In North Carolina Taxjar

States With Highest And Lowest Sales Tax Rates

Sales Tax On Grocery Items Taxjar

![]()

Prepared Food Beverage Tax Wake County Government

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

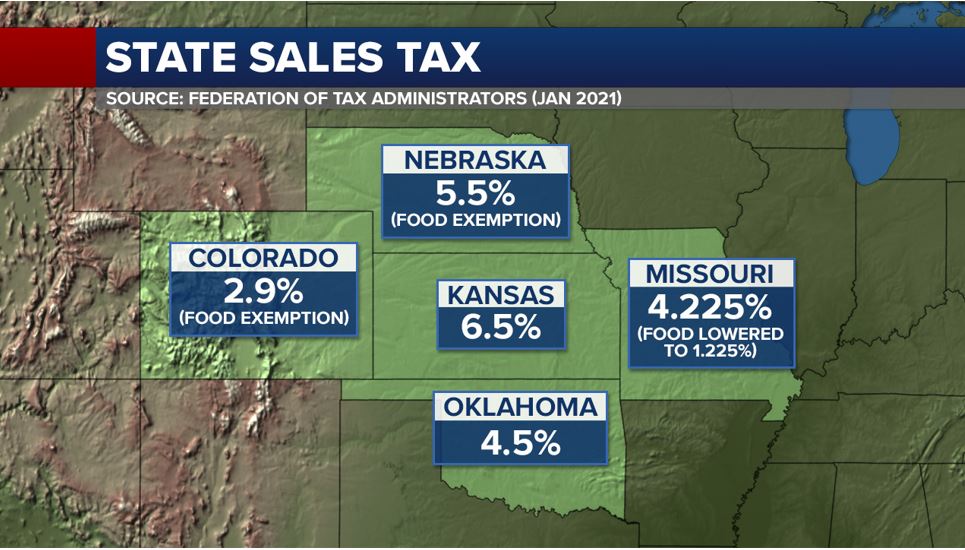

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

.png)

States Sales Taxes On Software Tax Foundation

Free Online 2018 Us Sales Tax Calculator For 89448 Zephyr Cove Fast And Easy 2018 Sales Tax Tool For Businesses And People From 89448 Z Sales Tax Topeka Tax